|

| The 2023 edition of the Craft Brewers Conference took place at the Music City Center in Downtown Nashville (Photo © Brian Brown/Beer in Big D). |

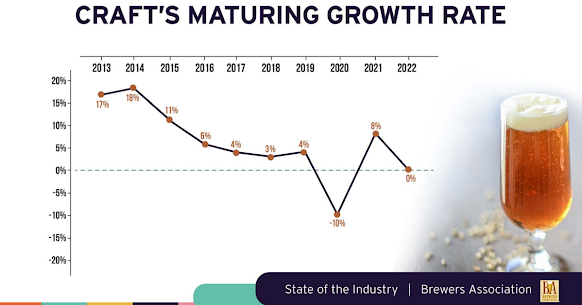

This "maturing growth rate," as described by Bart Watson, chief economist for the BA, was more normal and realistic as a long-term growth rate. Then, of course, the plague descended upon us, forcing the industry to reassess operations and pivot as needed to keep the doors open.

As the brewing industry gathered once again in Nashville for the 2023 CBC earlier this week, they were met with new, flat growth rates and presented with what Watson referred to as a "new normal" in terms of what to expect going forward, now that the market is more or less past the point of Covid recovery.

Details on what that means is provided in coverage of Watson's annual State of the "Craft Brewing Industry" address below. Also offered up are summaries of select research studies and seminar topics from the conference, along with the regular recap of local taproom visits and the 2023 World Beer Cup results.

Cheers!

State of the Industry

So, what exactly is this "new normal" for the craft beer industry?

As illustrated below, craft beer enjoyed double-digit growth rates from 2013-2015. This was followed by the more "mature" growth rates prior to the pandemic, after which the industry experience a recovery in 2021 leading to a growth rate of 8%. In 2022, however, things flattened out as craft beer production was on par with 2021.

|

| Image: Brewers Association. |

Taking a wider view, the average annual growth is a modest 1.5% over the past six years. And, according to Watson, similar numbers will be norm for the near future. The "new normal," that is, unless craft brewers do something to change it.

Watson was quick to add, though, that stagnant growth is not indicative of an industry undergoing zero change. There are bright spots. For instance, while regional brewers saw a 2% decline in growth, and micros (15K barrels or less) were up only 1%, hospitality-focused breweries (taprooms and brewpubs) were up 7%.

In other words, craft demand is still there, it's just being met in a different environment. Oh, but if there's a caveat, it's that hospitality concepts typically have a shelf life. This is evidenced in a 20% growth rate for brewpubs opening in 2018 or later, with only a 2% bump seen by those debuting prior to 2018.

Getting back to flat growth and the idea of a "new norm," naturally this extends to the brewery count as well - with openings and closings expected to be more in balance. In 2023, there were 529 openings (lowest since 2013) and 319 closings reported, resulting in a slight increase in the number of operating breweries to just under 9500.

|

| Image: Brewers Association. |

As for how to move forward, Watson says new placements (or occasions), new customers and new strategies are needed if the industry has hopes of returning to the elevated growth rates of the past.

In terms of barriers, competition in the alcohol segment is clearly impacting the industry, with beer losing ground to hard liquor and other beverage options. This applies to placements, as well as the ability to attract new customers.

For example, liquor has targeted what were formerly beer strongholds at sporting events, concerts and the like. This is an area, Watson says, where beer has to find a way to flip the script back.

Beyond that, new placements may be found with non-alcoholic beers. Are there untapped accounts where you can put a non-alcoholic beer in the hands of a consumer spending time where beer might not have been offered before?

Shifting to customer outlooks, growth is found in new demographics, specifically in the rapidly growing population of women and BIPOC drinkers. Problem is, craft beer has the lowest percentage of these drinkers across all beverage alcohol categories. This shines a spotlight on the need to connect with this diverse generation, so what is your brewery actively doing to welcome them to the craft beer party?

Lastly, focus...focus...focus. Chasing trends isn't a path to growth. When a trend hits, the market gets sliced up between breweries trying to deliver on the latest and greatest style. There's simply not enough growth to go around for everyone to win at this particular game.

Instead, Watson says to seek growth by leaning into what your brewery does best and touting that as a differentiator. Drive growth yourself, rather than chasing it.

Researcher Presentations

Despite the brewing industry perhaps being more hop-focused than ever, two research studies focused on malt were among the most interesting at this year's CBC. A short synopsis of each is presented below, but you can contact researchers directly for more information.

Infusion Malts - presented by Cristal Jane Peck, product innovation manager at Boortmalt.

- Question: As an alternative to adding adjuncts, why not bombard barley with exogenous flavor and aroma compounds to created complex and niche malt varieties?

- Results: A more rounded, layered effect was found in test cases, with new elements of taste and more complex expressions of flavor observed.

- Link to a related article on Belgomalt: "Malt with a touch of herbs and spices".

- Questions: What are the environmental and varietal mineral contributions to malt flavor? How does malthouse water and/or equipment contribute to house flavor? What are the effects of adding minerals to replicate famous brewing waters (Dortmund, Burton on Trent) - since such beers were likely brewed with malt made with those same waters.

- Results: The mineral profile of water impacts malt quality. A reduction in extract and an increase in enzymatics were observed, along with changes in color in pH.

Water treatment effects on mineral content vary. Higher levels of magnesium and potassium in water result in lower levels in the malt produced. Chloride and sulfate levels in malt derive more from the actual grain, and do not appear to be impacted by water treatments.

World Beer Cup

Formerly held every two years, the World Beer Cup (WBC) is now an annual competition put on by the Brewers Association. For the 2023 event, a total of 10,213 submissions were received from 2,376 breweries representing 51 countries worldwide. Judges evaluating those entries awarded prizes in 103 categories covering 176 different beer styles.

|

| Image credits: Peticolas Brewing Co., White Rock Alehouse & Brewery. |

Winners from North Texas included Peticolas Brewing Co. and White Rock Alehouse & Brewery, both of Dallas. Each brought home WBC honors for the first time in their histories.

- White Rock Alehouse & Brewery, Dallas: Silver for Big Thicket - Golden or Blonde Ale category.

- Peticolas Brewing Co., Dallas - Bronze for Turtle Kriek - Belgian Fruit Beer category.

Taproom Trips

|

| (Photos © Brian Brown/Beer in Big D). |

No comments:

Post a Comment